Insurance For Retailers

- Trusted By Over 180,000 Small Businesses

- Glass and Machinery Breakdown Cover

- No Paperwork, No Hassles, No Worries

While you’re helping customers treat themselves to a spot of retail therapy, let us do the shopping around for your business insurance. Whether you’re a florist, a gift store or the best bakery in town, in a few mouse clicks or a quick phone call, you can access multiple competitive quotes and get your retail business covered in minutes.

Working in retail, you are probably constantly interacting with customers, suppliers and members of the public, which increases the risk for something to go wrong.

Public Liability insurance is designed to provide protection for you and your business in the event a customer, supplier or a member of the public are injured or sustain property damage because of your negligent business activities*. This insurance can be particularly relevant for retailers whose operations can create slip, trip and fall hazards, which can result in hefty financial consequences.

A typical Public Liability policy for retailers may also include Product Liability cover which protects you and your business if your goods cause injury or damage.

Your customers are essential and so are your business assets. Having the right cover in place can help protect your back pocket when faced with those unwanted challenges.

Business Insurance policies can provide various covers* including:

Contents and stock – cover for your contents and stock against perils such as fire.

Building – covers the cost of repairing or rebuilding your business premises as a result of perils such as fire.

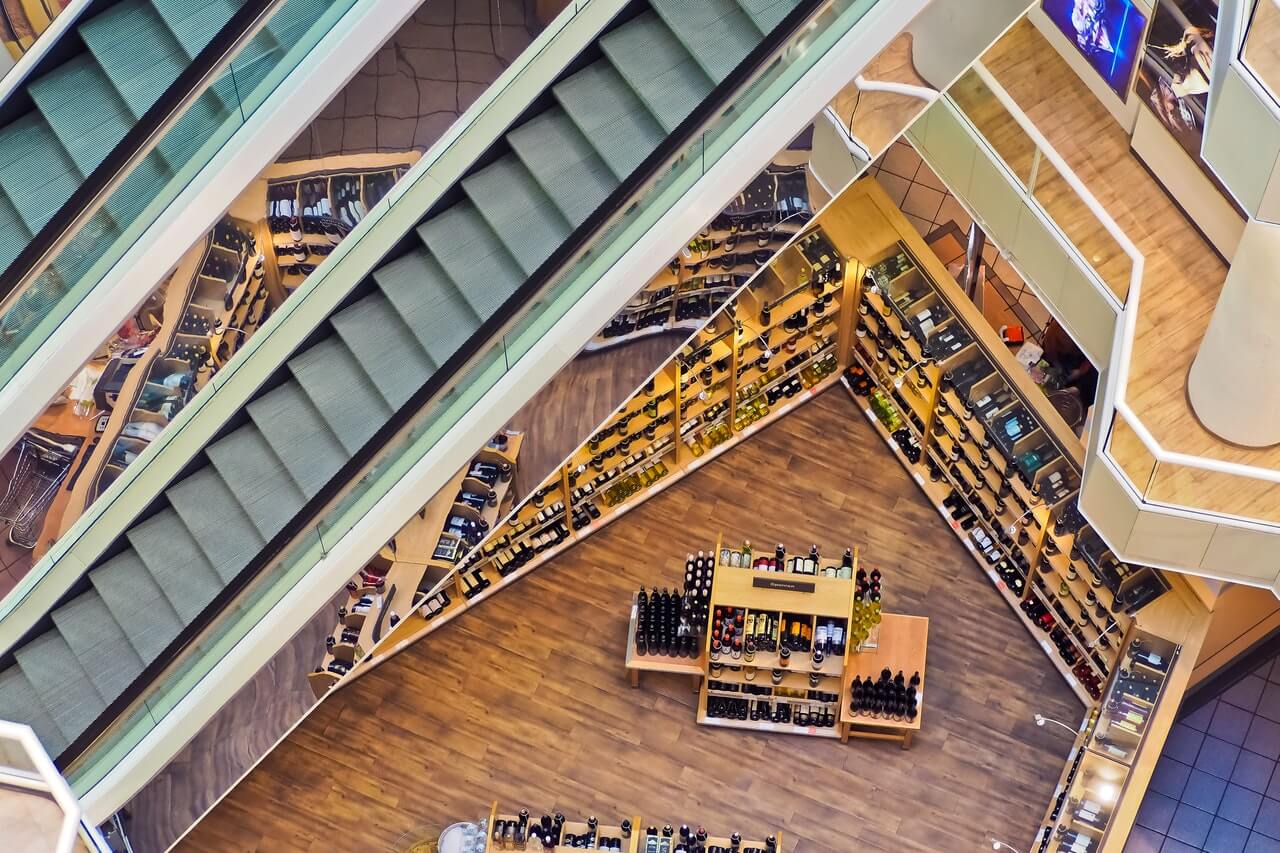

Glass – a common claim for retailers is for broken windows, glass shelving, showcases, mirrors, and porcelain. This policy section covers breakage to internal and external glass and signage.

Money – protect money belonging to your business from being lost, stolen or damaged whilst on your premises, in transit, or in your personal custody.

Employee Dishonesty – safeguard your business from losses resulting from employee theft or fraud.

Business Interruption – could your business bounce back after being shut due to an insurable event, for a few days, a week, or longer? Business interruption covers lost income and increased costs of operating your business that result from an interruption from specific events and can help to pay ongoing expenses and maintain profits.

Machinery Breakdown – covers damage to machinery caused by breakdowns as well as deterioration of stock in some circumstances, which is an optional extra that provides protection for loss of perishable stock if your fridge/s is inoperable due to breakdown.

You’re busy enough tending to your retail business, so a call from the Australian Tax Office advising your business is being audited is the last thing you want to hear.

Take the stress and expense out of a tax audit with Tax Audit cover. Tax Audit Insurance* covers a business for specified costs (in particular, external accountants’ fees) incurred in responding to an audit by the Australian Tax Office so you can continue running your business without the worry of the tax man on your back.

Take the time to understand the different types of risks your business is exposed to, and how insurance can help protect it. Our team of insurance specialists can help you find competitive insurance solutions to insure your retail business.

Factors such as the type of business, size and location of your retail store will assist our team in helping you to find suitable cover to protect your business.

Also, bear in mind that if you are renting your retail space, many landlords require their tenants to hold a minimum level of Public Liability cover as part of the rental agreement.

At Public Liability Australia we want to make arranging your retail insurance easy and hassle-free. We understand that there is no such thing as a ‘one size fits all’ solution when it comes to insurance, so you have the freedom to customise what type of insurance your business needs.

Get in touch with Public Liability Australia today to receive multiple quotes from some of Australia’s top insurers so you can compare, save and protect your business in minutes.

*As with any insurance, cover is subject to the terms, conditions and exclusions contained in the policy document

In the food industry, every restaurant business brings its own flavour and style to the…

Every restaurant has its own style and flair, but one thing they all have in…

When it comes to calculating the cost of Public Liability insurance premiums for hospitality and…